Why Having Good Credit is Important, And Understanding it

There are various reasons why you would want to raise your credit score, It could be that you want to take out a mortgage on your dream home or you’re praying to get approved for car financing or a personal loan. Even if you just want to raise your credit score to repair your credit just want to get a shinny new credit card, these tips should be able to get you on the right track.

In order to be approved for a credit card, loan, mortgage, financing etc, lenders will look at certain factors, like your job, income, and most importantly; your credit score.

Just about all lenders look at your FICO score to determine whether your credit is poor, fair, good, or excellent. The range of your credit score can literally make or break any deal with a potential lender.

Trust me it’s not something you want to go through, I’ve been at the car dealership anticipating getting a new car only to be denied because my credit wasn’t good enough

Having good credit is important, not only for making big purchases, but it can come in handy if you happen to need emergency funds. Your score can also determine how much interest, you will pay on a particular loan and can even determine the size of your monthly payments (the more excellent the score the lower the payment.

The diagram below is a more detailed breakdown of the typical credit range

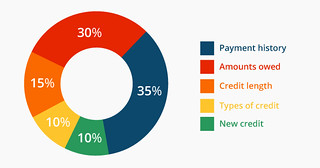

The next most important thing about credit you should understand is the different parts or factors that make up your credit score.

Once you can understand what makes up the majority of your score, you can focus on those sectors to raise your credit score faster. Your credit score is typically broken down into 5 cateogories:

- Payment history– are you making your payments, late on time, or before time.

- Amounts Owed– Total debt and outstanding balances

- Credit Length– How long have you held accounts in good standing, collections, closed accounts

- Types of Credit– Personal and student Loans, Mortgages, credit card

- New Credit– New cards and new loan approvals

As depicted in the image above the cateogories with the 2 most major impacts on your credit score are your payment history and your amounts owed as a combined total of 65% of your credit score. Luckily for you these 2 cateogories are things you can work on right away.

If you are like the average person you probably don’t have a lot of money to spend on paying back thousands of dollars worth of debt awesome enough there are some things you can do to raise your credit score without spending large sums of money, so here’s 5 tips to help you raise your credit score fast.

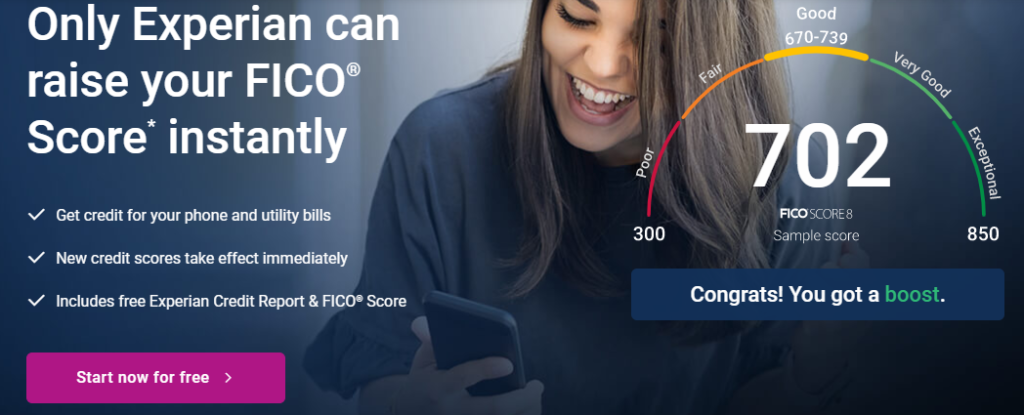

Experian Instant Credit Boost

What is Experian? Experian is a huge multinational consumer credit reporting agency. Experian offers several services ranging from checking your credit score, to monitoring your credit for fraudulent activity, they even offer live support for you to ask questions about your credit, but my favorite perk about Experian is that they offer a service called Instant credit boost!

Instant credit boost is exactly what it sounds like, an instant boost in your credit score. By using the instant boost to raise your score, you can raise your score on average by 13 points!

Experian looks at your account statements and gives you credit for bills, and utilities that you already pay on a monthly basis, which instantly boosts your credit score, and the score really does take effect immediately! Click this link here to head on over and get your FREE credit boost!

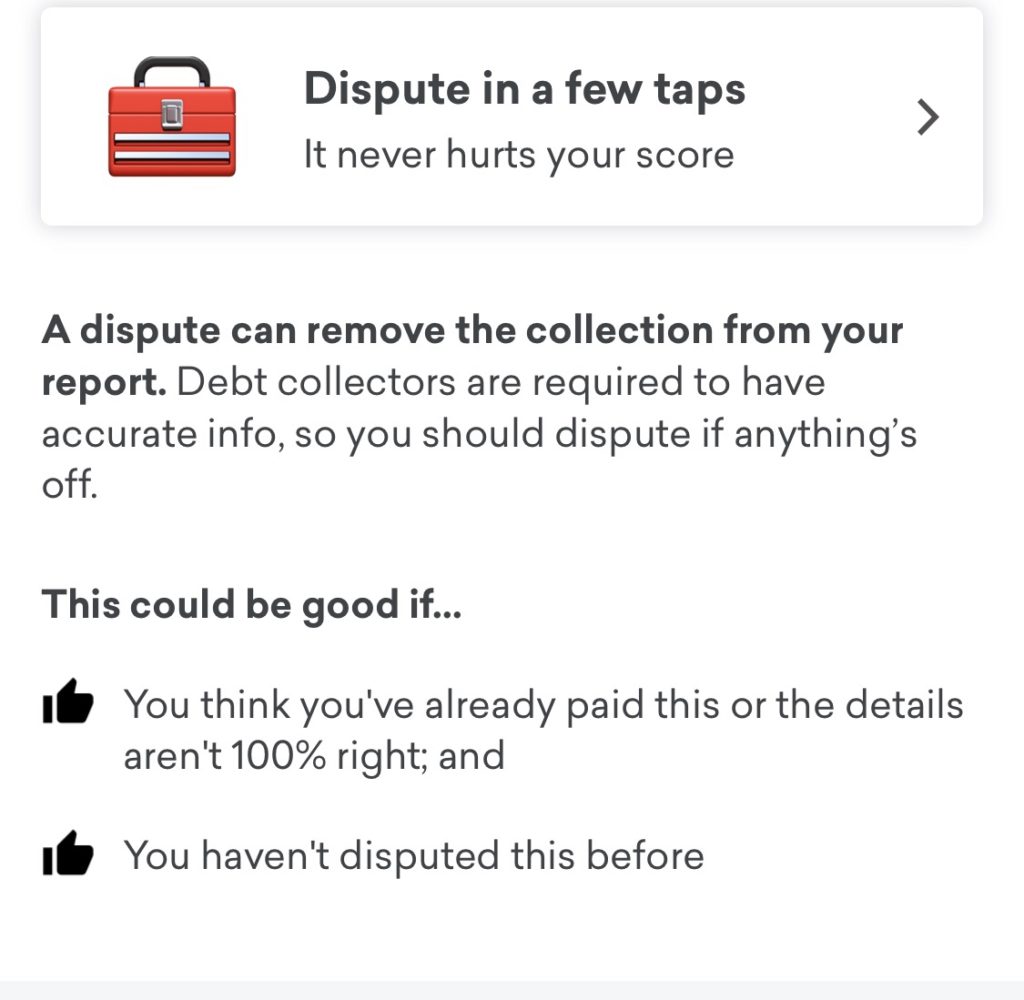

Raise Your Credit Score Tip #2-Dispute incorrect/fraudulent or unknown accounts

Disputing and removing faulty or incorrect accounts from your credit his can have a dramatically positive effect on your credit score! That is why it pays to really know everything on your credit report because you could have unknown credit errors lying around, crippling your credit score.

When you successfully dispute an account and have it removed, your credit score could easily jump over 20 points!

Luckily for us Experian, and Credit Karma are two sites and apps that let you view your entire credit history and will help you dispute accounts you believe to be errors for FREE!

Raise Your Credit Score Tip#3-Set up affordable monthly payments/ Consolidate Your Credit

If you can set up payment arrangements for outstanding balances that you owe. Since payment history and amounts owed makes up about 65% of your entire credit score, it makes sense that adding on time monthly payments, and decreasing outstanding balances will drastically raise your credit score.

You’re payments don’t have to be huge but they should be consistent. There are even companies that will help you consilidate your credit.

What does it mean to consolidate your credit? Consolidating your credit happens when a lender, or bank agrees to help you pay off your debt by combining all your outstanding balances into one lump sum,. In turn you only have to make a single payment each month to your lender.

Juggling several monthly payments on top of rent, utilities, and other bills can be stressful. Consolidating your credit simplifies the process of rebuilding your credit by combining monthly payments into one.

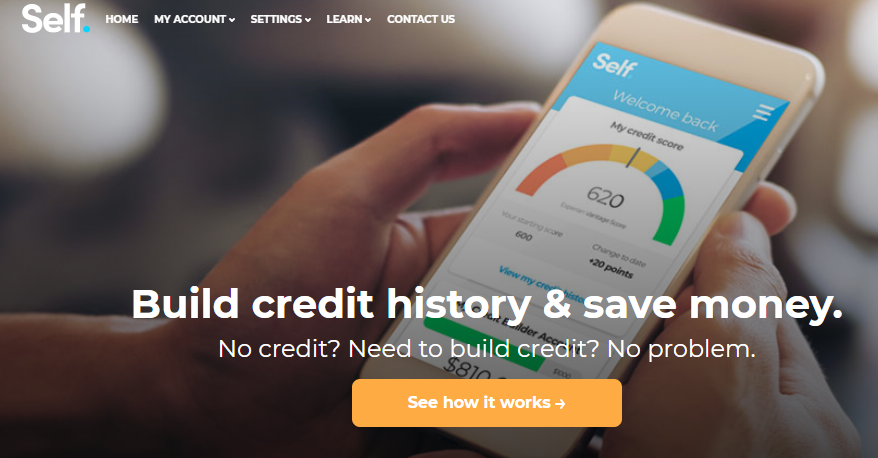

Raise Your Credit Score Fast Tip #4- Self Lender

What is SELF? Self Lender is an amazing credit monitoring tool that allows you to build credit and save money by making fixed monthly payments over a span of 24 months or less.

In a way Self is like a CD or Bond, where after your account has matured you can withdraw your money! The only difference is that your money doesn’t gain any interest.

Self Lender is great for people who are on the low end of the credit spectrum, looking to rebuild their credit, or those who are new to the world of credit and looking to establish credit history.

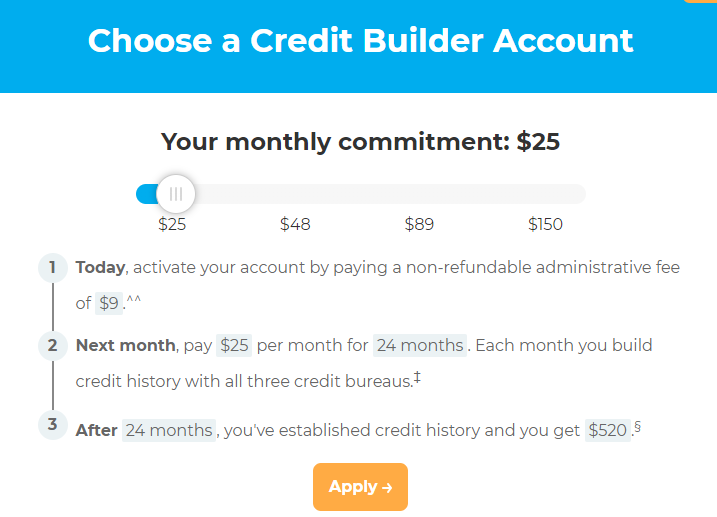

The only upfront cost you have to pay is a $9 fee to activate your account, after that you will begin paying the fixed monthly payment of your choice, $25, $48, $89, or $150. For minimum payments of $25, the span of your loan is 24 months. If you opt for one of the higher payments, the span of your loan will last for 12 months

People have raised their credit score by a whopping 100 points using Self Lender . So it is definitely 100% worth the try. Click here to visit their site and signup here

Raise Your Credit Score Fast Tip #4-Secured Credit Card

A secured credit card is similar to a credit building loan in the sense that you have to provide your own money upfront. Your deposit is what makes the card secure, so that there is no risk for the bank or lender.

After your deposit has been received and your account activated you can begin using your credit card as you would a normal credit card. Whatever you borrow you must pay back. Your credit limit is typically the same amount as your deposit

There are various banks and cards that offer various deposit amounts ranging from a minimum of $50 to a maximum of $3,000. Just like ordinary credit cards, these banks report to the major credit bureaus. If you make your payments on time this will help to raise your credit score.

Here is a list of some of best secured credits cards out there

With these 5 tips you should be well on your way to building up your credit and raising your credit score fast!

Enjoyed this post, check out my post on how to make money online